Are you a small business owner in Jamaica wondering about your tax obligations? Or maybe you’re considering starting a business and want to know what the tax implications are. Either way, this blog post is for you! We’ll cover all the basics of taxes for small businesses in Jamaica, so that you can confidently plan your finances and make sure that everything stays above board.

Introduction to Taxes in Jamaica

Jamaica has a variety of taxes which may apply to both individuals and businesses. Depending on the type of business, taxes can include Pay-As-You-Earn (PAYE) Income Tax, Education Tax, contributions to the National Housing Trust (NHT), the National Insurance Scheme (NIS), and Minimum Business Tax (MBT).

Also Read: What are the requirements to register a business in Jamaica?

For employers, PAYE income tax is charged at 3.5%, while employees are taxed at 2.25% after deductions of NIS contributions and other contributions. The MBT was implemented in April 2014 as a means of improving tax compliance in Jamaica. It is a flat rate tax calculated on all taxable profits for companies registered in Jamaica with an annual turnover greater than JMD 25 million. Start-up businesses are not required to pay MBT until after two years of operation.

In general, corporations are subject to a 25% corporate tax rate for listed companies and 35% for unlisted public or private limited companies. Banks, insurance and other financial institutions are subject to higher rates depending on their activities or sectoral classification by the government. Non-resident companies may also be liable for Jamaican sourced income taxes depending on their activities within the country’s borders.

Tax Requirements for Small Businesses

Tax requirements for small businesses vary depending on the country and region. In Jamaica, businesses must pay taxes in accordance with the Minimum Business Tax Act (MBT). This tax is a flat rate of JMD 60,000 which is paid in two equal installments.

The first installment should be paid by June 15th and the second by September 15th. Education Tax is also charged at rates of 3.5% for employers and 2.25% for employees after deductions are made for NIS contributions and other contributions. Additionally, resident corporations are taxable on their worldwide income while non-resident companies are taxable only on Jamaican-sourced income.

Moreover, start-up businesses will not be required to pay MBT until after two years of operations. Corporate Income Tax (CIT) rate is 30% computed on net income and entities whose gross income is equal to or below CRC 109 032 000 will be subject to the Small Business Tax Benefit Scheme which applies a reduced rate of 10%.

Corporate Income Tax

Corporate Income Tax is a type of tax that businesses must pay on their worldwide income. This includes profits from foreign branches and subsidiaries, as well as income earned locally. The 2020 representative corporate tax rate in Jamaica is 26.5%, which consists of 15% federal tax and 11.5% provincial tax depending on the province.

In addition to this, Jamaica has introduced a Minimum Business Tax (MBT) to improve tax compliance and encourage entrepreneurs to be more compliant with their taxes. The MBT went into effect in April 2014 and does not depend on the income, sales or assets of a business.

It is calculated by multiplying the number of employees by the applicable rate which ranges from JMD$2,000-15,000 per employee per year depending on the size of the business. Jamaica also imposes a General Consumption Tax (GCT) on certain goods and services at a standard rate of 16.5%, with exemptions for basic foods products.

Withholding Taxes

In Jamaica, businesses are required to pay withholding taxes in order to contribute to the government’s revenue. This includes Pay-As-You-Earn (PAYE) Income Tax, Education Tax, and contributions to the National Housing Trust (NHT).

Generally, corporations are taxed at 25% for listed companies and 35% for unlisted public and private limited companies. Banks, insurance companies and other financial institutions are subject to a flat tax of JMD 60,000 paid in two equal installments by June 15th and December 15th each year.

Additionally, all companies (except registered charities) must pay a Minimum Business Tax (MBT), regardless of their income. Companies can apply for a tax compliance certificate (TCC) if they pay their taxes on time. By paying withholding taxes, businesses help ensure that Jamaica has enough revenue to keep running smoothly.

Value Added Tax (VAT)

Value Added Tax (VAT) is a type of consumption tax that is applied to the purchase of goods and services. It is imposed on the supply of goods or services within a jurisdiction, such as Jamaica, and is typically collected from customers at the point of sale. Generally, VAT is charged at varying rates depending on the item or service being purchased, with some items being exempt from VAT altogether. The current standard rate in Jamaica is 15%.

VAT encourages savings by taxing only consumption rather than savings income. It also helps to create an even playing field between local businesses and foreign businesses that may not be subject to certain types of taxes in their home countries. In addition, certain tax incentives are available to developers or occupants under the SEZ Act including reduced rates of income tax and relief from General Consumption Tax (GCT).

For companies operating in Jamaica, it is important to understand how VAT works and how it affects your business operations. Companies must register for VAT if their turnover exceeds a certain amount per year and pay any taxes due on time in order to qualify for a 100% tax credit. Manufacturing or agricultural companies may also receive Value Added Tax (VAT) relief or exemptions depending on their activities.

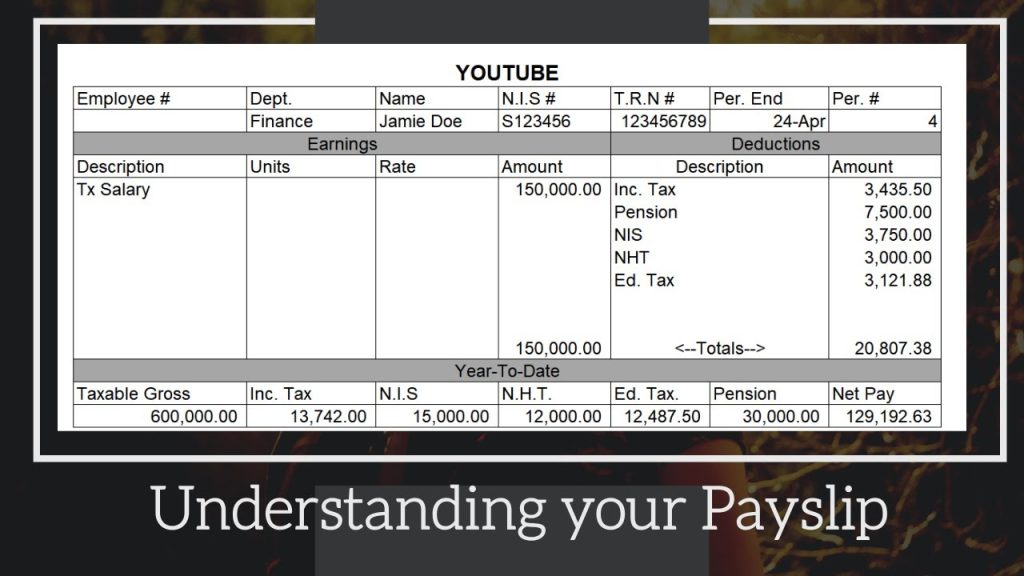

PAYE and NIS Contributions

Pay As You Earn (PAYE) and National Insurance Scheme (NIS) Contributions are taxes imposed on employers, employees, and the self-employed in Jamaica. PAYE is a system of deducting income tax from wages of employees below a certain threshold while NIS contributions are made by both employers and employees.

For PAYE workers, the base is gross emoluments (net of contributions to the NIS and the CSFBS). Employers must deduct 25% income tax from their employee’s wages under the stated threshold. To remit deductions of Ed. Tax, NHT, NIS and HEART contributions monthly to Tax Administration Jamaica and to file a return (SO2) at the end of each month; employers must register with the NIS office in order to make payments for both themselves and their employees.

For NIS Contributions, employers contribute 3% while employees contribute 2% on all taxable emoluments received from Jamaica. Both contributions are tax deductible for those who qualify for it. Employers should remit deductions monthly to Tax Administration Jamaica in order to meet statutory compliance.

Stamp Duty

Stamp Duty is a type of tax imposed on documents and transactions in Jamaica. It is calculated as a percentage of the value of the transfer, sale or lease. Stamp Duty must be paid before any documents related to these transactions can be legally executed. It applies to all types of property, including land, buildings and other assets. The amount of Stamp Duty due depends on the type of document being executed and may range from 1% to 5%. The government uses this tax revenue to fund public services and infrastructure development in Jamaica.

Property Taxes

Property taxes are a type of tax levied on property owners in Jamaica. These taxes are based on the value of the property and can vary depending on the size and location of the property. Residential and commercial properties are both subject to this type of tax and all owners must pay this in order to stay up-to-date with their obligations.

Property taxes must be paid annually, though some exemptions may apply depending on an individual’s circumstances. The money raised from property taxes is used to fund local services such as schools, roads and public transportation.

Special Consumption Tax (SCT)

Special Consumption Tax (SCT) is a tax imposed by the Jamaican government on the importation or local manufacture of certain goods and services. The rate of SCT depends on what is being imported or manufactured, with some items being taxed at a higher rate than others. SCT is paid in addition to General Consumption Tax (GCT), which applies to most goods and services except those that are zero-rated or exempted from GCT.

In order to encourage small businesses, the Jamaican government provides an income tax credit of JMD 375,000 for Micro, Small and Medium Enterprises (MSMEs). This credit is available for both companies registered under the Corporations Act, The Cooperative Societies Act and The Resort Cottages Act as well as companies registered under the Omnibus Incentives legislation.

The standard general consumption tax rate was recently reduced from 16.5% to 15%. Registered taxpayers should begin taking advantage of this reduction when filing their taxes in full and on time. Additionally, employers can access 30% employment tax credit when their taxes are paid in full and on time.

Environmental Levy

Environmental levy is a type of tax imposed by the Jamaican government for the purpose of protecting the environment. It is charged on imported goods and locally manufactured goods at a rate of 0.5%. This levy is payable to Tax Administration Jamaica and must be accounted for in an Environmental Levy Return (EL01)

. The money collected from this levy goes towards funding environmental protection initiatives, such as improving water quality, reducing air pollution, and maintaining protected areas. It is important for businesses to understand their obligations regarding this levy in order to remain compliant with Jamaican tax regulations.

Conclusion

In Jamaica, small businesses are subject to a variety of taxes and contributions. These include Pay-As-You-Earn (PAYE) Income Tax, Education Tax, National Housing Trust (NHT) contributions, and the Minimum Business Tax (MBT).

The MBT is payable by virtually all companies regardless of their income level, though registered charities may be exempt. Over the last decade, indirect taxes have made up around 52.2% of total tax revenue in Jamaica.

The Act to Repeal the Minimum Business Tax Act has been passed in order to reduce disincentives for formalizing businesses and partnerships. Lastly, Jamaica also has legislation that allows for transactional tax relief for international finance companies.