Are you thinking of starting a business in Jamaica? If so, you’ve come to the right place. In this blog post, we’ll cover all the requirements needed to register your business and get it up and running. From choosing a name to obtaining licenses and permits, we’ll make sure you have all the information you need to get started.

Research the Business You Wish to Register

Whether you’re starting a small business or launching a large corporation, researching the business you wish to register is an essential step. Knowing all of the legal requirements and paperwork involved in registering your business will help ensure that the process goes smoothly.

First, decide whether you want to form a sole proprietorship, partnership, corporation or limited liability company (LLC). Each type of business structure has different rules and regulations that must be met before registration can occur.

Second, research any local regulations that may affect your business. Depending on where you are located, there may be specific laws that apply to certain types of businesses or industries. Be sure to familiarize yourself with these laws before registering your business so you can make sure everything is up-to-date and compliant with the law.

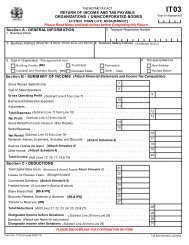

Thirdly, research any federal regulations or requirements for registering a business in your area. This includes obtaining necessary licenses and permits for operating a business in your region as well as filing taxes and other documents with the Internal Revenue Service (IRS).

Registration with the Companies Office of Jamaica requires an entrepreneur to fill out Form 6 (Companies Name Search and Name Reservation Form (opens in a new window/tab)) along with proof of residential address and TRN number. Additionally, they must pay re-registration costs which are JA$2,000 every 3 years as well as file The Business Registration Form (BRF1) – also known as the “Super Form” – prior to completing registration. Finally, if applicable they must also provide a work permit or exemption letter at this stage too.

Once all of these steps have been completed successfully then registration should be finalized without

Choose A Suitable Business Name

Choosing a suitable business name is one of the most important steps when setting up your business. A good name should be memorable, but also accurately describe what your enterprise does and stands for. It should also be legally compliant, to avoid any potential issues down the line.

When selecting a name, consider how it may look in print or online – is it easy to read, spell and pronounce? The last thing you want is for customers and investors to struggle with your company’s identity! Additionally, research other companies in your industry to ensure that no one else has already taken the same or a similar name.

Once you have settled on an appropriate company name, make sure to register it with the Companies Office of Jamaica. To do this, you will need to apply for a Name Search and Reservation Form (BRF1), which comes with a fee of $500 for the search and $3000 for reservation. Upon successful completion of this process, you will receive confirmation that your business name has been reserved.

Finally, don’t forget to get a Taxpayer Registration Number (TRN) from the Tax Administration Jamaica (TAJ). This number will be used whenever filing taxes or engaging in other activities related to tax compliance – such as opening a bank account or applying for government grants!

Choosing a suitable business name can be challenging but ultimately rewarding – once done right it could become an integral part of your brand identity! Follow these steps and you can make sure that your company’s name is both legal and memorable.

Decide on The Type of Business Structure

Deciding on the type of business structure is an important decision when starting a business in Jamaica. There are two main options to choose from: registering as a sole trader or partnership, or incorporating as a company.

Registering as a sole trader or partnership is the simplest and least expensive option. The process involves registering the business with the Companies Office of Jamaica, filling out forms and paying the necessary fees.

Incorporating as a company requires more paperwork and costs more than registering as a sole trader or partnership. Companies must be registered under the Companies Act and obtain a Certificate of Incorporation within four working days if all documents are in order. The fee for incorporation is $24,000.

Entrepreneurs must also register with the National Insurance Scheme (NIS) and become Taxpayer Agency compliant before setting up their business, but do not need to submit forms separately for this purpose.

Considering your options carefully before selecting the right business structure for you can help ensure your long-term success in Jamaica’s competitive market.

Complete the Necessary Paperwork for Registration

Registering your business in Jamaica can be a complex process that requires completing several important documents. After you have decided on the name and type of your business, you need to complete the necessary paperwork to properly register your company. This includes filling out a Business Registration Form (BRF1), providing proof of residential address and Taxpayer Registration Number (TRN) for each applicant, submitting three passport-sized photos per applicant, and paying the registration fee of $2500. Additionally, any changes in the documents at the time of registration must be filed with the Companies Office of Jamaica. Other documents such as a Statutory Declaration form or Statement of Particulars may also be required depending on the type of business being registered. With all these requirements fulfilled, you can finally submit all documentation to register your business with Jamaica’s Companies Office.

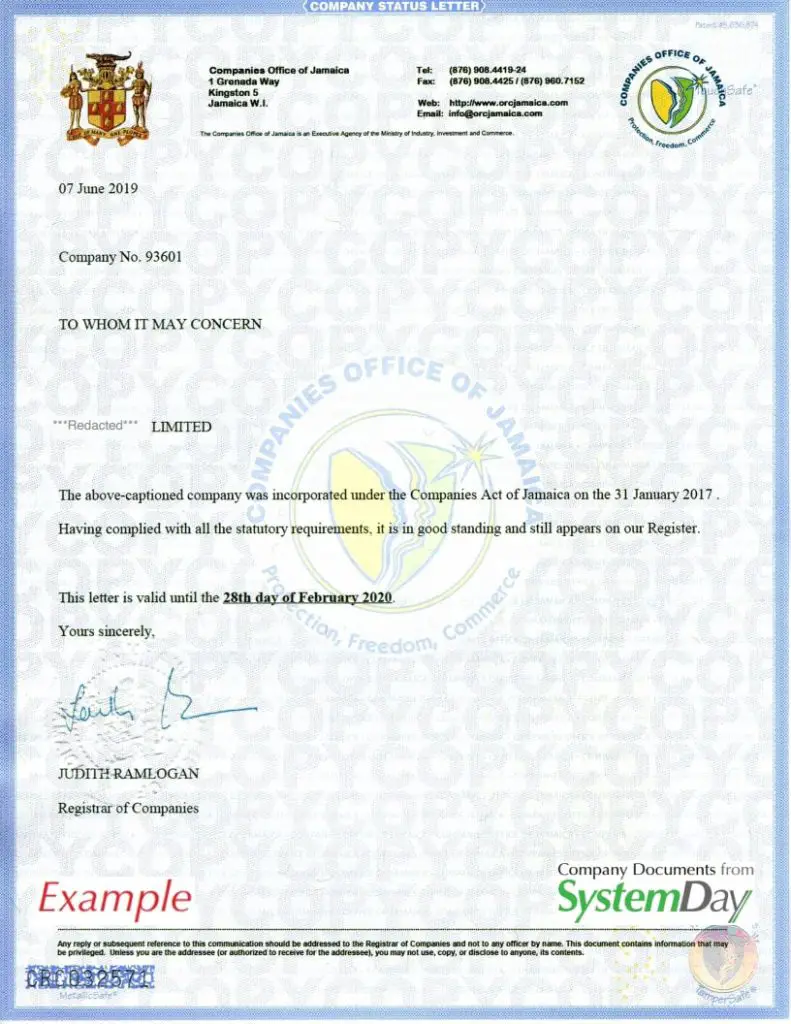

Register Your Company with the Companies Office of Jamaica

Registering your company with the Companies Office of Jamaica is a simple and straightforward process that can be done online. This registration is required for all companies operating in Jamaica. The process involves filing the Business Registration Form (BRF 1) “Super Form” which must include information such as the name of the company, nature of business, address and contact details. Additionally, certain documents such as a copy of the Articles of Association (if applicable) and a work permit or exemption letter must also be submitted along with the form.

Once these documents are submitted, they will be reviewed by an officer from the Companies Office who will then make sure that all relevant information has been included. After this review is complete, your business will be officially registered with the Office and you can begin to operate legally in Jamaica. The registration fee for new companies or businesses is $3,000 JMD while renewals or BRF registrations cost $2,000 JMD.

By registering your company with the Companies Office of Jamaica, you are ensuring that your business is compliant with all laws and regulations in place in order to protect both yourself and your customers. It also shows potential clients and customers that you are a legitimate business which can give them peace of mind when dealing with you.

Prepare an Incorporation/Registration Agreement

Incorporating a business in Jamaica requires the preparation and filing of an Incorporation/Registration Agreement. This document outlines the legal structure and requirements for forming a company in Jamaica. The agreement must be signed by all shareholders, directors, and officers of the corporation to ensure that everyone involved understands the rules and regulations they will be held to. The agreement serves as evidence of the company’s legal status, which is necessary for obtaining certain licenses and permits from government agencies. Additionally, it provides protection for shareholders and creditors by outlining rights, duties, liabilities, and other important aspects of corporate governance.

Obtain a Taxpayer Registration Number from Tax Administration Jamaica (TAJ)

Obtaining a Taxpayer Registration Number (TRN) from Tax Administration Jamaica (TAJ) is an important step for businesses and individuals who are starting or expanding operations in Jamaica. A TRN is required for many business activities, such as registering for Self-Employment Assistance Program, filing taxes, and obtaining a National Insurance Scheme (NIS) registration.

Individuals must submit a completed and signed ‘Application for Taxpayer Registration (Individuals) – FORM 1’ which can be obtained from the TAJ website or at any of their offices. The form must be accompanied by a copy of the applicant’s passport or driver’s licence (notarized by a Justice of the Peace). All applicants must also provide original documents that prove they are eligible to conduct business in Jamaica.

Once the application has been submitted, TAJ will review it and issue a TRN within two weeks. Once you have received your TRN, you can proceed with other business activities such as registering for NIS and filing taxes.

It is important to note that failure to obtain a valid TRN may lead to penalties from TAJ which could include fines or imprisonment. Additionally, businesses operating without a valid TRN may not be able to access certain legal benefits such as tax credits or deductions.

Secure Any Required Licenses and Permits

Secure any required licenses and permits is an essential step in the process of registering a business in Jamaica. All businesses must meet certain requirements to be legally allowed to operate, such as obtaining a work permit or exemption letter where applicable. It is also important that any changes in documents at the time of registration are filed with the Companies Office of Jamaica. Furthermore, there may be additional licensing and registration requirements depending on the type of business you are operating. For example, cosmetic, food or device making therapeutic claims may require additional registrations. Additionally, food establishments must apply to the Medical Officer of Health before operating. Lastly, a single application form should be completed and delivered to any FLA office with supporting documents for further processing.

Open a Bank Account in the Company’s Name

Opening a bank account for your company is an important step in setting up and running a business. A bank account gives you the financial security to manage your business’s income and expenses, as well as access to banking services and products that can help you manage and grow your business.

When opening a bank account for your company, it’s important to understand the different types of accounts available, the fees associated with them, and what documents you need to provide.

The type of account you open will depend on the size of your business, its activity level and the banking services you are looking for. For example, if you’re just starting out with a small business, then a basic checking or savings account may be best suited for your needs. On the other hand, if you have more complex operations or more capital involved in your operations then it may be better to open an investment or merchant account.

In order to open a bank account for your company, some documents will likely be required by most banks including: proof of identity (such as a driver’s license or passport), proof of address (such as utility bills), articles of incorporation (if applicable) and any other relevant documentation related to the ownership structure of your company. Most banks will also require references from at least two unrelated individuals who can vouch for the integrity and character of both yourself and any other officers associated with the company.

Once all requirements are met, most banks should be able to open an account within 1-2 weeks depending on their internal processing times. Once opened however, it is important that any payments made into this new bank accounts are separated from personal funds so that accurate financial records can be maintained

Register With National Insurance Scheme (NIS)

The National Insurance Scheme (NIS) is a social security program in Jamaica that provides benefits to employed persons aged 18 and over. To be eligible for these benefits, you must register with the NIS. This registration process involves submitting a completed form and notarized identification document to the NIS office.

Registering with the NIS is simple and fast. Start by filling out the Employee Registration Form, which can be found at any NIS office or online on their website. Provide your name, address, date of birth, contact information and other relevant details as requested on the form. Once you’ve completed it, submit it to an NIS office along with a notarized ID document such as a driver’s license or passport.

Once your registration is processed by the NIS team they will provide you with an official National Insurance Number (NIN). This number will allow you to access all of the benefits associated with being enrolled in the scheme including unemployment allowance, pension contributions and more.

It’s important that all changes made to your personal information are also filed with Companies Office of Jamaica (COJ). This includes changes to marital status or address as well as any name change made after registering for an NIN.

If you are employed in Jamaica then registering for an NIN is essential for accessing all of your government-funded benefits so make sure to take this step today!

Hire Employees

Hiring employees is a critical part of running a successful business. When you hire employees, you are taking on the responsibility of providing them with a safe and productive working environment, as well as training and development opportunities. It’s important to understand the legal requirements associated with hiring employees in Jamaica so that you can ensure compliance at all times.

When it comes to recruiting and hiring, employers must meet certain requirements in order to comply with Jamaican law. This includes having a valid Employment Contract and ensuring that all potential employees are legally allowed to work in Jamaica. Additionally, employers must also adhere to the National Minimum Wage Act (NMWA) which sets out the minimum wage for workers in Jamaica.

Employers should also be aware of their obligations under the Employment Protection Act (EPA), which outlines employee rights such as reasonable notice periods for termination of employment and payment for holidays taken by an employee during the course of their employment. Employers should also verify that any new employee has a valid work permit or visa before they start work so that they can avoid any potential legal issues down the line.

Finally, employers should provide adequate health and safety training for their employees so that they can stay safe while performing their duties. This includes providing safety equipment such as gloves, masks or protective eyewear if necessary, as well as ensuring that hazardous materials are stored correctly and correctly labeled at all times.

Advertise Your Business

Advertising your business is a key part of building a successful brand. It allows you to reach more customers, create awareness for your business, and build trust with potential buyers.

The most important thing to remember when advertising your business is to make sure that your message resonates with the target audience. You should use different types of advertising techniques to appeal to different groups and ensure that everyone knows what you are offering.

One way to advertise your business is through the use of traditional methods such as print ads, radio commercials and television spots. These can be expensive but can reach a large audience quickly. Social media platforms like Twitter and Facebook are also great tools for spreading the word about your business. Additionally, online marketing opportunities like search engine optimization (SEO) can help increase the visibility of your website in search engine results pages (SERPs).

You should also consider creating email campaigns or newsletters to stay in touch with current customers and attract new ones. Offering discounts or special promotions can also be an effective way to drive sales while increasing customer loyalty.

Finally, don’t forget about guerrilla marketing tactics such as using street teams or creating fun events around town. These tactics may require more effort but they can be incredibly effective if done correctly!

Conclusion

In conclusion, registering a business in Jamaica is relatively straightforward and can be done quickly and efficiently. All companies must register under the Companies Act, though not all persons operating a business need to do so.

The cost for registration is $24,000.00 and the minimum paid up capital required is $50,000.00. The branch must have a registered office in Jamaica for incorporation process to be complete. Entrepreneurs are not required to submit forms separately to the National Insurance Scheme (NIS) or Taxpayer Agency.

The first online business registration form in the Caribbean has been launched in order to improve Jamaica’s investment environment and make it easier for entrepreneurs to do business there. Additionally, all MSMEs must be registered with the Companies Office of Jamaica (COJ) in order to comply with local regulations. With all requirements taken care of, registering a business in Jamaica should be an easy process and open up new areas for businesses looking to expand their operations into this country.